Origins of Coinage and its Role in Early Economies

The Humble Beginnings of Metal Currency

Picture this: a bustling ancient marketplace where traders haggled over goods like grain, pottery, and livestock. It’s hard to imagine, but there was a time when coins didn’t exist. Back then, bartering was the lifeblood of commerce—trading a basket of apples for a bolt of fabric or a jar of honey. But let’s face it, hauling around sacks of goods to negotiate every deal wasn’t exactly… efficient.

Enter the revolutionary idea of coinage, a spark of genius that emerged in ancient Lydia (modern-day Turkey) around 600 BCE. With coins made of electrum, a naturally occurring blend of gold and silver, Lydia flipped the switch on economies worldwide. No more wondering how many chickens equal a bag of grain—coins turned commerce into something more precise, portable, and fair.

How Coins Transformed Early Trade

The brilliance of coinage wasn’t just its convenience; it fundamentally reshaped human connections and economic practices. Coins became so much more than shiny bits of metal—they were symbols of trust and value. Here’s what they brought to the table:

- Standardization: Each coin carried a consistent weight and design, making them universally recognizable.

- Portability: A handful of coins could replace a cartful of goods, making long-distance trade a breeze.

- Authority: Stamped with the face of a ruler or emblem of a city-state, coins reflected political power and legitimacy.

Imagine Lydian merchants passing these coins from hand to hand, each exchange fueled by newfound speed and trust. Coins weren’t just tools; they were catalysts for flourishing economies and expanding empires. Whether buying a loaf of bread or striking deals across borders, early coinage laid the foundation for thriving monetary systems.

Development of Trade and Market Systems through Coinage

When Coins Revolutionized Human Connections

Imagine a bustling ancient marketplace: traders shouting out their wares, the aroma of spices hanging heavy in the air, and handshakes sealing deals. But then—enter the **coin**. Small, portable, and undeniably valuable, these metallic marvels didn’t just pay for goods; they changed everything about how people traded.

Before coinage, bartering ruled the day. Need wool? Better hope the other person wanted your grain. With coins, this awkward dance transformed into a fluid exchange system. Suddenly, value was universal, precise, and compact—no more lugging sacks of barley to trade for one weaving loom!

This wasn’t just local magic; entire economies began to breathe differently. For instance, ancient Lydia’s invention of the first coins sparked a trade boom stretching from the Aegean to the East. Coins became passports for goods and ideas, carrying stories of distant lands in their gleaming surfaces.

The adoption of coinage wasn’t simply transactional—it spread courage. It whispered to travelers and merchants alike: “Take the risk. Venture further.”

Coinage and the Establishment of Monetary Policies

The Power of Coins to Shape Economies

The introduction of coinage wasn’t just about having shiny bits of metal in your pocket—it was a seismic shift, one that quietly rewrote the rules of economies around the world. Imagine this: before coins, trade was like an awkward dance of bartering. A fisherman might swap cod for grain, but what if the farmer didn’t need fish? Enter coins—a universal solution, simplifying not just transactions but shaping how societies thought about value itself.

But here’s where it gets interesting. Coins didn’t only facilitate trade; they gave rulers the power to control economies. By minting currency and stamping their faces onto it, leaders essentially said, “This is our standard.” They could regulate silver content, set rules for circulation, and even determine who got to use it. That’s monetary policy in its earliest—and arguably most tangible—form.

- Lead content down? Decrease metal weight, but keep that shiny surface the same.

- Eager to expand? Print more coins to fuel trade (though that had consequences).

Coins were more than money—they were tools for control, innovation, and yes, sometimes chaos when policies went awry.

Technological Innovations and the Evolution of Currency

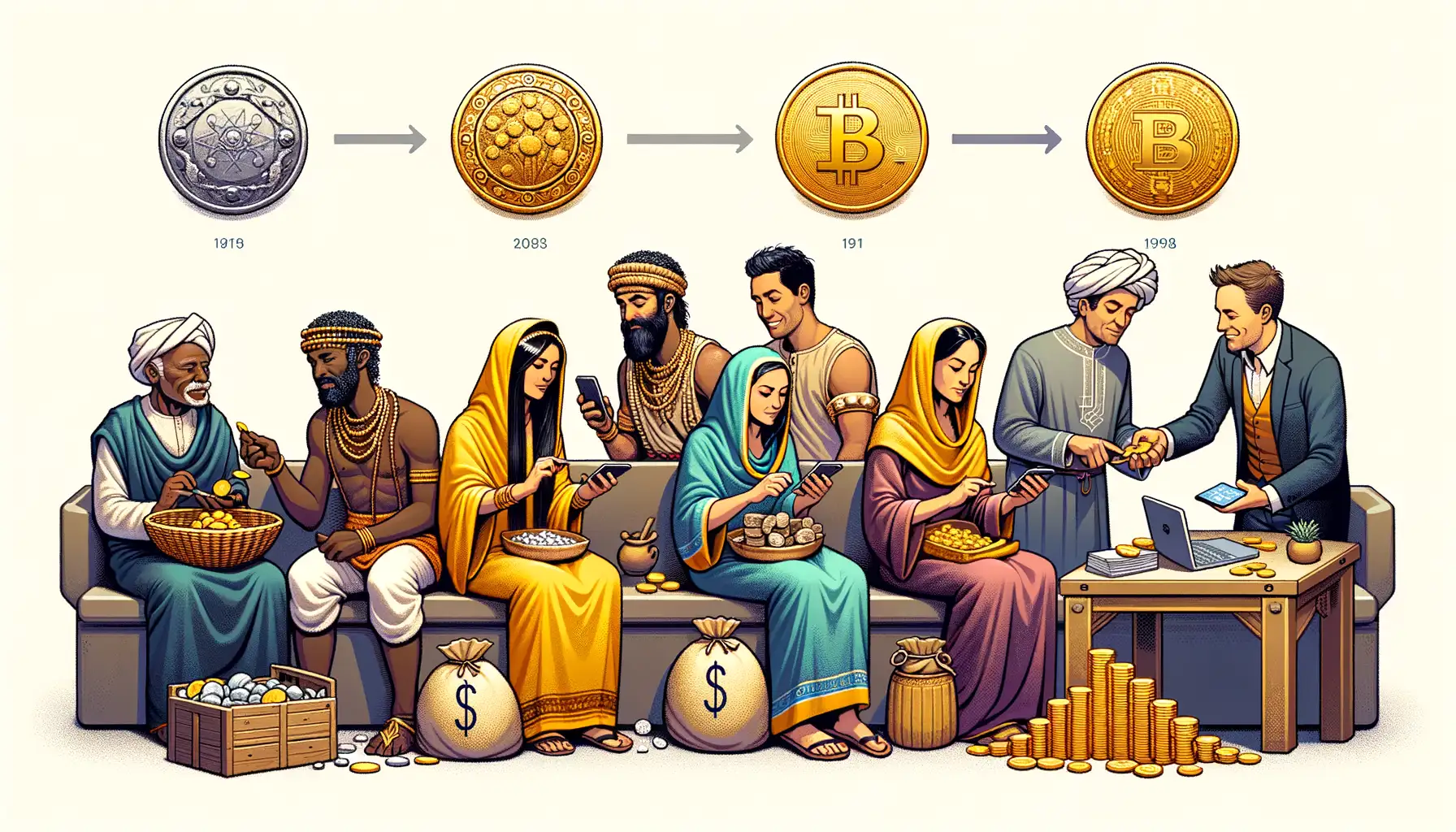

The Digital Dawn: From Coins to Codes

Imagine holding a heavy, cold coin in your hand—a solid token of value forged from earthy metals. Now fast-forward to today, where a “click” on your smartphone sends digital currencies halfway across the world in seconds. Isn’t it staggering how far we’ve come? The evolution of currency has ridden the wave of technological innovation, transforming from something you could physically hold to something as intangible as a line of code.

Take, for instance, the invention of the printing press. It didn’t just revolutionize books—it made paper money possible, allowing nations to abandon the clunky inconvenience of carrying sacks of coins. Then came the rise of computers and revolutionary payment systems like PayPal and Venmo. These platforms shattered geographical barriers, making transactions as effortless as sharing a meme.

- Blockchain technology: the backbone of cryptocurrencies like Bitcoin, offering unparalleled security and decentralization.

- Contactless payments: tapping your card or phone feels like magic, but it’s all thanks to near-field communication (NFC).

This constant metamorphosis tells an inspiring story: our relationship with “money” is endlessly adaptable, always embracing the next big thing.

Modern Economic Implications of Historical Coinage

The Ripple Effect of Ancient Coins in Today’s Markets

Step into any bustling marketplace or open your favorite trading app, and you’re likely witnessing echoes of history unfolding. The use of coins—those small, clinking powerhouses of exchange—did more than revolutionize ancient economies; their legacy continues to shape modern financial systems in fascinating ways.

Consider the global obsession with precious metals. Did you know that the value of modern currencies often mirrors the confidence people once placed in physical coins made from gold and silver? The psychological trust tied to material worth remains, affecting how we view everything from dollar bills to Bitcoin.

- Numismatics—the study and collection of coins—fuels financial speculation today, breathing life into auctions where ancient drachmas sell for millions.

- Even economic models like inflation tracking borrow concepts pioneered by analyzing historical coin debasement.

And here’s a twist: blockchain technology owes a conceptual debt to ancient coinage. Those stamped, official guarantees of value were the original trust mechanisms, much like modern digital ledgers promise security and authenticity. A Roman denarius isn’t so far removed from the cryptocurrencies of our time.

Coins may be out of our pockets, but they’re still on our minds—and in our algorithms.